What is the Most Important Insurance in New Jersey?

Insurance is a financial product that assists individuals in managing risks and protecting themselves from unforeseen financial losses. You pay an insurance provider a certain amount called premiums in exchange for coverage against unexpected incidents. The Division of Insurance of the New Jersey Department of Banking and Insurance (DOBI) regulates insurance products and the state's insurance industry.

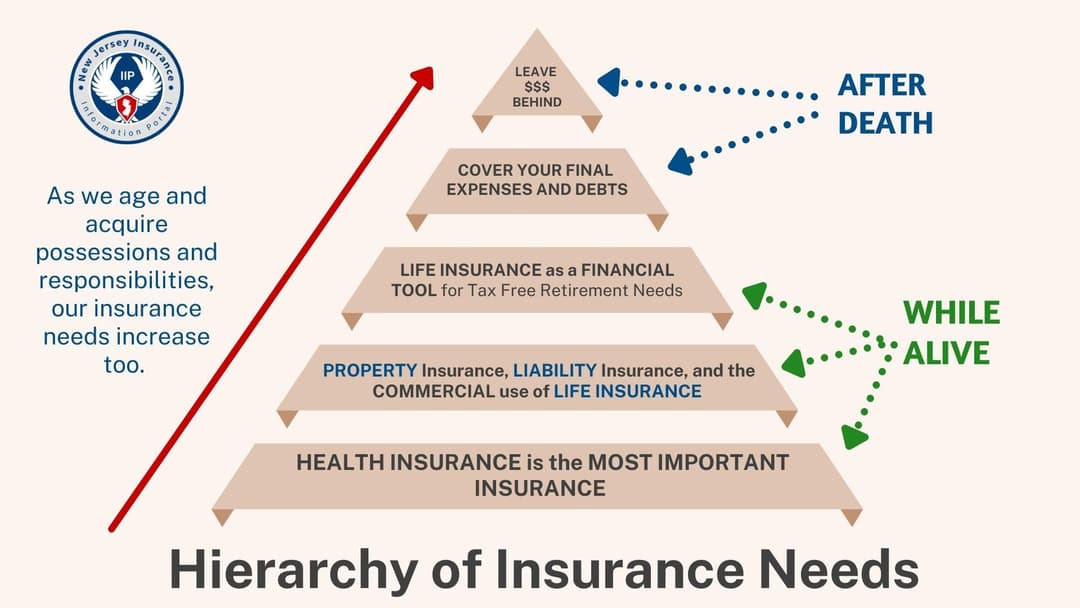

Depending on the unique needs, each of the over 9.2 million New Jersey residents requires one or more forms of insurance to protect against unanticipated events and prevent financial complications in the event of such incidents. Health insurance is the most important in the Hierarchy of Insurance Needs. Health insurance is an insurance product that helps pay for medical expenses and provides access to health services without having to break the bank.

Property and liability insurance is the next most important insurance after health insurance in New Jersey. It provides financial protection against property damage and third-party liabilities for individuals and business entities. Common examples of properties covered by property and liability insurance in New Jersey include automobiles, residential, and commercial properties. The third is life insurance, an insurance product that guarantees payment of a certain sum, known as a death benefit, to an insured's named beneficiaries after the death of the insured. Depending on the type of life insurance, an insured can also enjoy some benefits, commonly called living benefits, on their policy while still alive.

The Most Important Insurance in New Jersey:

HEALTH INSURANCE

Health insurance is an insurance product that helps pay the cost of a person's expected and unexpected medical and surgery expenses, subject to the insured's insurance coverage terms. Having a health insurance policy in New Jersey can protect you from the financial complications usually associated with medical emergencies or ongoing treatments, especially considering the rising medical care costs. According to the HART Program blueprint, the U.S. per capita health care cost will go up by an average of 4.5% annually between 2019 and 2028. This blueprint was published by the New Jersey Office of Health Care Affordability and Transparency in March 2022. With the rising medical costs, treating illnesses out of pocket may deplete your savings.

In New Jersey, you can get health coverage under either the private health insurance system or the public or government-funded/public health system. Most government-sponsored health insurance plans, including Medicare, Medicaid, and CHIP, are designed for low-income earners and seniors. The three major state-designed health insurance programs in New Jersey are:

Individual Health Coverage Program (IHC)

Small Employer Health Benefits Program (SEH)

Medicare Supplement Program for Individuals Eligible Due to Disability

The Individual Health Coverage Program (IHC) guarantees access to health coverage for individuals who do not have access to public or employer-sponsored health care programs, regardless of health status or age. On the other hand, the Small Employer Health Benefits Program (SEH) is designed to ensure small employers' access to small group health benefits plans regardless of group members' health status and occupation. It gives employees and their dependents a right to continue coverage even if they no longer qualify for the group's health plan. The DOBI provides New Jersey residents and small employers with the IHC buyer's guide and SEH buyer's guide. The New Jersey Medicare Supplement Program for individuals eligible due to disability is designed to meet the health insurance needs of persons under 65 who qualify for Medicare for reasons besides age. This program caters to two groups: individuals under age 50 and those between 50 and 64.

Different Marketplace health insurance plans are sold at various metal levels on New Jersey's official health insurance marketplace, commonly known as Get Covered New Jersey (Get Covered NJ). These include:

Health Maintenance Organization (HMO) Plans - An HMO plan is a type of health insurance plan that provides health services through a network of healthcare providers. Although HMOs are affordable, the plan limits coverage to medical care from doctors who work directly for HMOs or contract with them

Preferred Provider Organization (PPO) Plans - These plans offer a list of pre-approved healthcare providers. However, unlike HMO plans, you can also use hospitals or doctors outside the network without a referral, although at additional costs. Most PPOs apply a 60/40 split when you see an out-of-network provider or doctor, meaning that your insurer pays 60% of the costs while you bear the remaining 40% out of pocket

Exclusive Provider Organization (EPO) Plans - An EPO plan gives you moderate liberty than HMO plans and allows you to choose any health care provider within the EPO's network. Unlike PPO plans, EPO plans do not provide coverage for out-of-network providers, except for emergencies

Point of Service (POS) Plans - With a POS plan, you pay less for health care when you use doctors or healthcare providers within the plan's network. You can use out-of-network hospitals or doctors by getting a referral from your primary physician. However, you will have to bear a larger percentage of any out-of-network medical care expenses out of pocket

Other common types of health insurance in New Jersey include:

Commercial health insurance plans

High deductible health plans (HDHP)

Long-term care insurance (LTC)

Long term disability insurance

Commercial health insurance is mostly employer-sponsored and administered by non-governmental agencies (private insurance). An example of commercial health insurance is disability income insurance, commonly known as temporary disability insurance in New Jersey. It protects against wage loss by employees if they become unfit to earn income, especially due to illnesses or disabilities. Employer-sponsored group health plans are also part of this group, while insurance for the self-employed typically comes from the individual health marketplace or through an agent

High-deductible health plans (HDHP) have higher deductibles than most other health plans. A deductible in health insurance is the amount you must pay for health care services before your health plan kicks in. Generally, you pay lower premiums with the HDHP plan but pay more out of pocket whenever you need medical care coverage from your insurer

Long-term care (LTC) insurance provides coverage for people with long-term needs, especially seniors with disabilities, cognitive disorders, and prolonged illnesses

Long-term disability insurance pays a portion (typically 50% - 60%) of your income if you become dsabled and cannot work

Make sure to discuss your health insurance needs with experienced and state-licensed professionals who have access to multiple insurers and competing quotes.

Why Do you Need Health Insurance?

In 2021, out of the nearly 9.2 million people in New Jersey, 8.7% of the state’s residents under the age of 65 were without proper health insurance. According to 2019 U.S. Census Bureau Small Area Health Insurance Estimates (SAHIE) survey conducted for over 7.2 million under-65 New Jersey residents, almost 700,000 of them did not have any form of health coverage. Lack of access to good preventative care is often associated with inadequate health insurance coverage; hence, the reason you need health coverage in New Jersey.

In New Jersey, you need health insurance because of the following reasons:

Rising Medical Costs - Affording healthcare services costs may be challenging with increasing medical costs. With proper health insurance coverage, you and your family members can obtain quality treatment at top-notch medical network hospitals without having to spend your life savings

Provision of Essential Health Benefits - Health insurance can provide essential health benefits, including emergency services, prescription drugs, hospitalization, ambulatory patient services, and laboratory services. Other are pediatric services (vision and oral care), rehabilitative and habilitative services, preventive and wellness services, mental health services (including substance use disorder), and maternity care services

Lifestyle Changes - Habits like smoking, eating junk foods, and other lifestyle choices can lead to life-threatening illnesses. Health insurance can step in such circumstances to cover medical costs in managing or treating such critical illnesses

Access to Preventive Services - Most health insurance plans, including those available through the Get Covered NJ, provide free preventive care such as screenings, vaccines, and certain check-ups, even while you are yet to meet your deductible

Financial Protection - Health insurance can protect you from unanticipated and financially catastrophic health situations, such as organ failure, that require considerable money for transplant costs

Planning For Upcoming Treatments - If you know that you have upcoming medical procedures and treatments, you should update your health insurance plan accordingly. All ACA-compliant plans give the insured an opportunity to modify their coverage every year during the enrollment period (typically 1 November - 15 January). Once the need passes, the following year, you may be able to lower the coverage and save on the monthly costs

You can get health insurance through several ways in New Jersey. While some get coverage through their employers, others purchase coverage on their own or get coverage through government-sponsored programs. Depending on your health insurance coverage type, you either receive reimbursement from your insurer for health care expenses paid out of pocket, or your insurer pays the healthcare provider directly. It is best to review your options with a New Jersey-licensed health insurance expert, an agent who can help you make the best choice for health coverage.

The 2nd Most-Important Insurance

PROPERTY and LIABILITY Insurance: Personal and Business

Property and liability insurance, commonly known as property and casualty (P&C) insurance, covers multiple insurance products designed for individuals and businesses in New Jersey. The Office of Property and Casualty of the DOBI is charged with rates regulation and supervises all forms of P&C insurance activities in the state. The primary purposes of property and liability insurance are:

To indemnify insureds for property loss that they may suffer due to covered perils

To guarantee insureds against civil liability before third parties for which they are legally responsible, hence, protect them financially

Although property and liability insurance includes two separate coverages, they are commonly bundled together for adequate protection. Generally, property insurance in New Jersey provides property coverage for property owners, who can either be individuals or businesses. It reimburses them for damage to or losses of their properties or their contents for covered perils like vandalism, theft, and select weather-related disasters such as smoke, fire, lightning, hail, the impact of ice and snow, and wind.

In New Jersey, you may insure your property and contents (for buildings) for actual cash value (ACV) or replacement cost value (RCV). Actual cash value (ACV) coverage pays an insured the depreciated value of their property in the event of a covered loss. Conversely, replacement cost value (RCV) coverage pays an insured the cost of replacing or repairing lost/damaged property based on replacement cost values without considering depreciation. It is the recommended property coverage for businesses as it can help them recover from covered losses faster.

Liability insurance New Jersey protects insured persons or businesses against claims resulting from property damage or injuries sustained by third parties for which insureds are found liable. It also covers you if a third party files a lawsuit against you for being responsible for their property damage or bodily injury. Common personal liability coverages in New Jersey include property damage liability, bodily injury liability, umbrella, and personal liability insurance. For a business, types of liability insurance coverage include general liability insurance, cyber liability, commercial auto liability, product liability insurance, vicarious liability insurance, commercial umbrella, and professional liability insurance.

The following insurance products are the widely purchased property and liability insurance in New Jersey:

Auto Insurance

Residential Insurance

Commercial Insurance

Disaster Insurance

AUTO INSURANCE

Auto insurance is a contract in which you pay an insurance provider a certain amount periodically in exchange for specific auto coverage(s). It protects you from bearing car accident-related costs and the costs of other covered losses like theft, an act of nature, fire, or vandalism. Typical coverage is purchased for 6 or 12 months, while short term car insurance, and even daily car insurance can be also obtained.

New Jersey is a no-fault state. This means you must file a claim with your car insurance company if you get into a vehicle accident, whether you are at fault or not. A typical New Jersey car insurance policy will pay you for car repairs, medical expenses, and property damage, up to your policy limits, if you are involved in an accident.

New Jersey law mandates every driver to carry minimum auto liability coverage; otherwise, they commit an offense punishable by cash fines, jail time, or license suspension. The required minimum auto insurance limits for all drivers in New Jersey are:

$15,000 per person, $30,000 per accident for bodily injury

$5,000 per accident for property damage

$15,000 for personal injury protection

Note: The minimum auto liability coverage in New Jersey is expected to increase for all policies renewing in 2023, and again in 2026.

The annual average cost of auto insurance in New Jersey is anywhere from $816 to $1,140 for minimum coverage and between $1,620 and $2,076 for full coverage. Speaking with a licensed P&C insurance agent will help you understand the prevailing rates, depending on the insurer, and subject to factors such as vehicle type/model/production year, its location, annual mileage, gender and age of the insured driver.

Although car insurance can either be personal or commercial auto insurance, New Jersey broadly categorized car insurance types as basic auto insurance and standard auto insurance. Although coverage provided by basic insurance can be enough to meet the state's minimum auto insurance requirements, it only offers limited benefits. In contrast, standard auto insurance provides better coverage and more protection than basic insurance.

The common auto insurance coverages offered by New Jersey P&C insurers include:

Property Damage Liability Coverage - Pays for damages done to a property after a car accident, including other people's vehicles or fixed objects like fences or poles

Bodily Injury Liability Coverage - Covers medical payments for occupants in another vehicle if you are at fault in a car accident

Uninsured/Underinsured Motorist Coverage (UM/UIM) - This protects you if you are involved in a car accident with an at-fault driver who is either uninsured or underinsured. An underinsured driver is someone whose insurance policy is not sufficient to cover your damage

Collision Coverage - Covers your car if hit by a hit-and-run motorist or at the insured driver’s fault in an auto collision

Personal Injury Protection Coverage (PIP) - Regardless of who is at fault in a car accident, PIP coverage can cover lost wages, medical payments, and even funeral costs (in the case of death) for you and the passengers in your car

Medical Payments Coverage - No matter who is at fault in a vehicle accident, medical payments coverage pays up medical expenses for you and your passengers up to your coverage limits

Comprehensive coverage - Covers most non-collision damages and other damages beyond your control, such as damage caused by floods, vandalism, falling trees, earthquakes, fires, explosions, or theft

Other car insurance coverages sold by auto insurance companies in New Jersey are:

Rental car coverage

New car replacement coverage

Gap insurance coverage

Roadside assistance coverage (Towing coverage)

Why Do you Need Auto Insurance in New Jersey?

Generally, you need auto insurance in New Jersey to help pay the costs associated with car repairs or replacement and liability costs in the event of a covered incident. Also, it is illegal not to carry the required state's minimum auto insurance limits as a driver. The Fatal Accident Investigative Unit of the New Jersey State Police recorded over 500 fatal car crashes, with almost 600 fatalities in 2020. Similarly, the New Jersey Department of Transportation (NJDOT) reported over 250,000 road crashes in the state in 2019 and nearly 200,000 in 2020. The drop in 2020 is due mostly to the COVID-19 pandemic and resulting shift to working from home.

Since New Jersey is a no-fault state, drivers involved in car crashes without auto insurance would have to cover repair or replacement costs of their damaged or totaled vehicles out of pocket. They will also be responsible for paying medical expenses for injuries sustained. In some cases, they may also face the legal consequences for not having the required state minimum auto coverage.

In New Jersey, you need auto insurance because:

It can allow other people, especially those living with you, to drive your car since auto insurance typically follows a car

It can protect your business' assets in the event of litigation after a vehicle accident (for commercial auto insurance)

It can pay for third-party liability costs if the passengers in your car sustain any injuries, depending on the type of coverage in your policy

It can pay the legal costs incurred if an accident victim chooses to file a lawsuit against you for damage or injuries sustained in a car accident you caused

It can pay for your medical bills if you sustain an injury in a car accident

It can pay the repair costs of your vehicle for damage caused by incidents other than collision

Although car insurance offers numerous benefits in New Jersey, it is not just enough to purchase an auto insurance policy. Besides the state-mandated coverage and limits, it is essential to identify what other optional auto coverages can provide you with additional protection based on your unique needs. Your best bet is to discuss your needs with a licensed P&C insurance agent who can help you determine the suitable auto coverage options and limits for such needs.

RESIDENTIAL INSURANCE

Residential insurance is a type of P&C insurance that provides a person with financial protection in the event of unforeseen damages or losses to their home or the house contents. Commonly called home insurance, residential insurance in New Jersey can also cover third-party liability, a person's legal responsibility for property damage or injuries sustained on their (insured's) property or house.

Over 9.2 million residents in New Jersey live in over 3.7 million housing units. Although not required by law, each housing unit is expected to have one form of residential insurance to protect against destructive incidents, such as fires, vandalism, and theft. Most New Jersey home insurance can also pay additional living expenses up to a person's policy limit if an insured needs to find temporary accommodation if a covered event renders their home inhabitable.

A typical New Jersey residential insurance policy comprises several coverages that offer residents overall protection. The widely purchased coverages in most home insurance policies include dwelling, personal property, and liability coverage:

Dwelling Coverage - Also known as hazard insurance, dwelling coverage covers a home's physical structure, such as the walls and roof, and attached structures like your garage. Generally, a residential insurance policy's dwelling coverage helps pay your home's rebuild or repair costs in the event of a covered peril. Depending on policy type, it is essential to have an amount of dwelling coverage that will be enough to build a home from the ground up in the event of irreparable destruction

Personal Property Coverage - This coverage helps pay for what is inside your home (personal belongings) in case of a covered incident. Personal property includes your furniture, clothing, certain jewelry, and electronics. Personal property coverage also covers your stuff, even if they are stolen or damaged by a covered event outside your home. When choosing your residential policy's personal property coverage, make sure that you understand the difference between actual cash value (ACV) coverage and replacement cost value (RCV) coverage

Personal Liability Coverage - This coverage protects you if a third party files a claim or a lawsuit for sustaining bodily injury or property damage on your property or in your home. Generally, it covers medical expenses incurred from treating the injured person and legal costs if you are sued

Other coverages common with most New Jersey residential insurance policies are additional living expenses and additional structures coverages. Additional living expenses coverage helps pay for the extra costs you incur when your home becomes uninhabitable due to a covered peril. Such costs may include hotel bills, feeding costs, and the cost of transporting some of your personal belongings to the temporary lodging. Additional structures coverage, also known as other structures coverage, covers the physical structures of detached buildings on your property or home, such as a detached shed, garage, shop, or barn.

Although there are various types of residential insurance, the most commonly purchased ones in New Jersey are:

Homeowners insurance

Condo insurance

Landlord insurance

Renters insurance

Your choice of home insurance policy depends mainly on the kind of home in which you reside. Besides policy type, you must also select certain coverages based on your unique needs. It is best to employ the services of a New-Jersey licensed P&C insurance agent to avoid over-insurance or underinsurance while purchasing a residential policy. Professional agents understand the property insurance market and can advise you appropriately based on your needs.

HOMEOWNERS INSURANCE

Homeowners insurance in New Jersey is a form of residential property insurance that provides homeowners who live in their own home coverage to rebuild or repair their homes' structures in the case of a covered event. It can also cover their personal belongings' repair or replacement costs if damaged or destroyed by a covered event. Common insurable events in New Jersey homeowners insurance include theft, falling objects, wind and hail damage, vandalism, smoke, and fire. Typical homeowners insurance policies also cover damages from weather events like hail, wind, and lightning. However, most do not provide coverage for earthquakes, sinkholes, and floods. You can get these coverages at additional costs as riders to your homeowners insurance policy or purchase them as separate policies. You may qualify for flood coverage through the National Flood Insurance Program (NFIP) if your home insurance provider does not offer flood insurance. The Federal Emergency Management Agency (FEMA) oversees the NFIP and offers flood insurance policies through independent insurance agents in the United States, including New Jersey.

Homeowners insurance can protect you financially if someone other than you or any resident of your home sustains bodily injury or property damage on your residential property. It will pay for the medical expenses for treating such injuries and legal fees if such a person sues you. Also, New Jersey homeowners insurance covers additional living expenses while repairs are ongoing in your home after a covered event, and you need to live in temporary accommodation.

The types of homeowners insurance policies offered by New Jersey P&C insurance companies are HO-1, HO-2, HO-3, HO-5, HO-7, and HO-8. The HO-3 policy is the most commonly purchased and accounts for most single-family home policies. The different policy types vary based on covered perils. Hence, it is essential to understand what is and is not covered by your policy. Generally, you will pay more premiums for a policy with broader peril coverage than one with fewer covered risks. In New Jersey, your lender may require you to provide evidence of having homeowners insurance if you have a mortgage. The essence is to ensure that their investment is secured by insurance. Otherwise, homeowners insurance is not legally mandated in New Jersey. However, purchasing one as a homeowner is strongly advised, considering the many benefits.

Why Do you Need Homeowners Insurance in New Jersey?

Generally, homeowners insurance will not prevent damage to or destruction of your home or personal belongings. In New Jersey, you need homeowners insurance because it can provide financial protection if unforeseen and insurable circumstances damage your dwelling or personal possessions. So, your insurance company will pay, subject to your policy limits, instead of paying out of pocket for such damages or losses. Besides coverage for your dwelling and personal property, homeowners insurance also provides cover for other detached structures on your property. Additionally, you need homeowners insurance because it can pay for third-party liability claims and additional living expenses.

In 2021, there were nearly 3 million homeowners policies in New Jersey across 130 insurers, which was a 2.88% increase over the 2020 number 18 months earlier. According to a report by the Insurance Information Institute (III), in 2020, about 64.3% of New Jersey housing units were owner-occupied.

Contact a New Jersey-licensed P&C insurance agent if you intend to get homeowners insurance. A knowledgeable property insurance agent can leverage their professional relationships with various approved insurance companies to find you a suitable and affordable homeowners insurance policy. They can also provide answers to any question you may have pertaining to homeowners insurance.

RENTERS INSURANCE

Renters insurance (HO-4) covers unexpected events in your rented apartment, including theft/damage of personal belongings, bodily injuries, and property damage suffered by third parties in your rented home. It does not cover a rented home structure and liability for dog bites, especially if your dog is considered a high-risk breed like Pitbulls. Also, renters insurance does not cover damage caused by floods or any other severe natural disaster. If you live in a flood zone in New Jersey and require more coverage for your personal belongings, you can purchase flood insurance as a separate policy. If your insurer does not offer flood insurance, you can get it from the National Flood Insurance Program (NFIP) through a licensed independent insurance agent.

Why Do you Need Renters Insurance in New Jersey?

The most common renters insurance claims are for theft, vandalism, fire, and bodily injury. In 2022, nearly 36% of the housing units in New Jersey (>1.3 million) were occupied by tenants. While renters in New Jersey spend an average 35% of monthly income on rent, over 17% of tenants (≈230,000 units) spend more than 50% of their yearly income on housing expenses. In 2021, the average monthly rent in New Jersey was almost $1,400.

As a tenant who wants to avoid the financial implications of an unexpected loss from a theft, fire, or a liability suit, your best option is to get renters insurance. New Jersey renters insurance can provide peace of mind for $100 - $200 per year. You need renters insurance in New Jersey because a typical renters policy can provide coverage for or against the following:

Your personal property - Covered events include fires, property crimes (vandalism and theft), and certain severe weather conditions (strong winds, tropical storms, hail, heavy snows, and extended freezing temperatures)

Temporary displacement - Also known as loss of use coverage, renters insurance can pay for your temporary living expenses if a covered incident renders your rented home uninhabitable

Liability - Pays for medical bills if you or any household member is liable for injuries or property damage sustained by a third party in your rented home. It can also cover legal costs if the third party chooses to file a lawsuit against you. (Note: Maximum renters insurance liability limit in New Jersey is $500,000. Additional coverage can be obtained through an umbrella policy)

Employing the services of an experienced P&C insurance agent to purchase renters insurance in New Jersey is advised. A knowledgeable agent will help you shop for renters insurance quotes from different insurers and can educate you on what is and is not covered by typical renters insurance policy based on your circumstances.

CONDO INSURANCE

As a condominium unit owner in New Jersey, condo insurance, also known as HO6 condo insurance policy, can help you cover replacement or repair costs if a covered event damages or destroys your personal belongings within your condo unit. As a home insurance product, condo insurance can also provide coverage for any improvements made to your condominium unit. Some of the perils covered by typical condo insurance in New Jersey are fire damage, vandalism, theft, and water damage.

Although home condo insurance works similarly to homeowners insurance, it is specifically designed to meet the unique needs of condominium units. It does not cover the actual building of the condominium (which is insured by the condo association’s Master condo insurance policy) and certain severe natural disasters like earthquakes, mudslides, and floods. Additionally, condo insurance in New Jersey does not cover damages due to insect infestations or those caused by a lack of proper maintenance of a condo unit.

Why Do you Need Condo Insurance in New Jersey?

In New Jersey, condominiums are usually the preferred choice of many people for owning a home. Unfortunately, if you live in a condo unit, you will have no option but to live in close proximity to many other unit owners whose activities may affect you adversely. Hence, the responsibility to protect your personal possessions and the interior of your condo unit primarily lies with you. Besides, since your condo association's master policy will only cover the building structure and other common areas of the condominium, getting your own condo insurance policy is smart.

You need condo insurance in New Jersey because the actions or inactions of other condominium unit owners are beyond your control. For instance, if a fire breaks out due to your neighbor's negligence and you suffer personal property damage, you may have to replace such items out of pocket if you do not have condo insurance. The same applies when an insurable weather-related incident damages the interior of your condominium unit. Although not mandatory by law, you also need condo insurance in New Jersey because most lenders in the state will require it to protect their investment before giving you access to credit (loan). A typical New Jersey condo insurance policy offers coverage for property damage (for interior ceilings, walls, fixtures, and floors), liability, and personal belongings. It can also provide loss of use coverage like a homeowners policy.

Condo insurance average cost in New Jersey is $500-$700 per year, with personal property coverage of $50,000, liability coverage of $100,000, and $1,000 as a deductible.

Your best option is to have a New Jersey-licensed P&C insurance agent analyze your needs before purchasing a condo insurance policy. A knowledgeable agent will ensure not to leave any coverage gaps and prevent your policy from overlapping the coverages included in your condo association's master policy. Contact a residential property insurance agent to get a condo insurance quote.

LANDLORD INSURANCE

Landlord insurance is a form of property insurance required by landlords who rent out their residential properties. In New Jersey, a residential rental property may be a vacation home, single-family house, house, large-apartment community, townhouse, condo, small multifamily building, or apartment building. New Jersey landlord insurance covers property owners from potential financial losses with their rental properties. It can pay all the costs required to repair a rental property in the event of a covered peril, such as certain natural disasters, vandalism, theft, and malicious property damage.

A typical New Jersey landlord insurance provides coverage for the dwelling and other structures on a rental property. It also covers the landlord's personal property used for servicing the rental building. Additionally, landlord insurance can help pay the medical bills for other people who sustain injuries on your rental property, especially if you are liable for such an accident. It may also pay legal expenses for liability claims. For instance, if your tenant slips and falls around the pool at your rental property, a landlord insurance policy may pay for legal costs if a court finds out that the lack of maintenance led to the accident. Landlord insurance does not cover tenants' personal belongings or the maintenance of equipment in rental properties

Why Do you Need Landlord Insurance in New Jersey?

One of the best investments anyone may have is owning a rental property. If you do not live in the owned property yourself, and choose to rent it out, you need landlord insurance because regular homeowners policy will not work for you. Landlord’s insurance can protect against the financial losses that may result from third-party accidents and other liability claims. Typically, landlord insurance covers loss of rental income and will compensate you for lost rentals if your rental property suffers any damage due to a covered loss and requires repair. Additionally, it can pay for some property damage caused by your tenants. It is vital to state that your homeowners insurance will not cover your rental property, hence the need for landlord insurance.

Generally, landlord insurance is meant for non-owner-occupied residential property. If you own the property in which you live in New Jersey and rent out a space to someone else, you are not qualified for lanlord insurance. In such a situation, it is best to discuss with your insurance agent to determine whether adding coverage to your homeowners insurance policy is possible.

Speak with a state-licensed residential property insurance agent to get a landlord insurance quote. Expect your New Jersey landlord insurance cost to be up to 25% higher than the homeowners policy for the same property.

COMMERCIAL INSURANCE

Also known as business insurance, commercial insurance in New Jersey provides financial protection for businesses of all sizes, business owners, and their employees from several unexpected events. Typical risks faced by businesses include property damage or theft, customer lawsuits, natural disasters, employee or customers' bodily injuries, and cyberattacks. Commercial insurance is broadly categorized into business liability insurance and commercial property insurance. While business liability insurance helps pay for the legal costs of suits filed against a business, commercial property insurance covers business property's repair or replacement costs.

The commonly purchased commercial insurance types, depending on the business and their needs, in New Jersey include:

Commercial Auto Insurance - Commercial auto insurance provides coverage for vehicles used for business operations and covers vehicle damage and liability

Commercial Property Insurance - Protects a business's physical property and assets. Business property that stays in one location, such as buildings, equipment, and furniture, is covered by the main policy. Meanwhile, inventory or cargo in transit or storage is insured by inland marine insurance or ocean marine insurance depending on the mode of transportation

General Liability Insurance - This covers risks like client property damage, advertising injuries, and customer bodily injuries for which the business, products, or employees are legally responsible

Business Owners Policy Insurance (BOP) - This generally bundles general liability coverage and commercial property insurance into a single policy to cover a broad range of a business's risks

Business Interruption Insurance - This pays a business for lost income if it has to stop operations for a certain period due to a covered event

Errors and Omissions Insurance (E&O) - This provides liability coverage for a business for professional mistakes such as negligent acts or missed deadlines leading to customers' financial losses. It is also called professional liability Insurance.

Cyber liability Insurance - This protects a business against the financial consequences that damage and loss from cyberattacks and data breaches may cause it

Workers' Compensation Insurance - This protects a business financially when an employee files a lawsuit against the company for sustaining injuries during work. It also pays for medical expenses and employees' lost wages due to time off after a workplace casualty. All employers in New Jersey are mandated by law to carry workers' compensation insurance. If the employer wants to provide a higher level of coverage to its employees, where the limits can be adjusted as needed, it may offer Occupational Accident Insurance (OAI)

Commercial Crime Insurance - This provides coverage for a business against theft, forgery, and fraud by employees or customers

Commercial Health Insurance - Some employers provide health insurance for their employees and their family members via group health plans, meanwhile health insurance for self employed in New Jersey is frequently obtained on the individual health marketplace. Because of the high number of small businesses in New Jersey, the state legislature created the Small Employer Health Benefits (SEH) Program in 1992. The SEH Program gives small employers access to health coverage for their employees

Commercial Life Insurance - Some New Jersey employers offer group life insurance policies. Since the death benefit of such plans is typically not very high (under $50,000), it is frequently used as a supplemental life insurance in addition to other policies an employee may have on their own

Why Do you Need Commercial Insurance in New Jersey?

According to the New Jersey Business Action Center (BAC), the state's small businesses are an essential part of its economy, ranking 11th in the U.S. in the number of small businesses. A 2019 report by the United States Business Administration Office of Advocacy (SBA) revealed that New Jersey had nearly 900,000 small businesses that year, representing 99.6% of the state's businesses. These businesses account for almost 50% of New Jersey employees. Any unforeseen event can render a business without the needed form of a business insurance policy bankrupt and possibly lead to job loss by its employees.

You need commercial insurance in New Jersey because running a business is a serious responsibility, part of which is risk management. However, you cannot effectively manage your business risks without adequate commercial insurance, among other things. For instance, according to a report by the U.S. Bureau of Labor Statistics (BLS), almost 76,000 non-fatal on-the-job injuries and illnesses were reported by private industry employers in 2020. That same year, there were 82 fatal work injuries in the state. Many of these risks are entirely beyond employers' control. If an injured employee or customer sues the business, the business will have to pay for medical expenses and legal costs from their working capital if they do not have the requisite commercial insurance policy. You primarily need commercial insurance to protect every investment that goes into your business and to minimize your losses.

It is not enough to purchase a commercial insurance policy in New Jersey. If you must get one, get it the right way by employing the professional services of a licensed commercial insurance agent. A knowledgeable agent will help assess your business needs and determine the suitable coverages for such needs while ensuring not to leave any gaps.

DISASTER INSURANCE

Disaster insurance is a term used to describe specific types of insurance providing coverage for severe natural disasters. While typical New Jersey residential and commercial insurance policies may extend coverage to damage due to storms, hail, wind, fires, and lightning, they do not cover unpredictable and extreme natural disasters. For instance, while the standard property insurance will cover a roof blown off by a tornado, it does not cover earthquakes, landslides, and floods. If your property insurance company does not offer these coverages as add-ons or riders, purchasing them as separate policies is your best option. Popular among such policies in New Jersey are flood insurance and earthquake insurance. Depending on the common disaster in your area, having a disaster type-specific insurance policy will help you to plan and prepare for unforeseen events.

Why Do you Need Disaster Insurance in New Jersey?

You need disaster insurance in New Jersey because almost all 21 counties are vulnerable to one or more severe natural disasters. The state has a history of natural disasters that have led to several billion dollars in damages. In 2021, the United States Disaster Department of Agriculture (USDA) designated five New Jersey counties as primary natural disaster spots. The designation resulted from the excessive rain between August 21 through September 2 and hurricane Ida between September 1 and 2, 2021. The affected areas were in Warren, Morris, Hunterdon, Sussex, and Somerset counties.

As revealed in a New Jersey State Risk Assessment Overview, some declared disasters in the state between 1955 and 2018 affected all 21 counties, while others happened in selected counties. These disasters include severe storms and flooding, wildfires, hurricanes, tornadoes, coastal storms, and high winds. The assistance funding disbursed via grants and business loans to victims in all instances of disasters those years indicates their awful impact on individuals, families, and businesses. In many cases, such funding may not come in handy quickly, and the level of damage may deteriorate before help finally arrives. In contrast, your insurance company can quickly come through if you have a disaster-specific insurance policy and suffer property damage due to a covered peril. In that case, you will not have to pay out of pocket for replacement or repair costs or wait till government intervention comes before salvaging the situation.

Knowing what is and is not covered by your standard New Jersey property insurance policy is crucial. Never assume that your regular property policy covers extreme natural disasters without checking with your P&C insurance agent, who can help interpret the policy contract. A local professional agent is familiar with the prevalent disasters in your locality and is best positioned to advise you on the disaster-specific coverages to purchase if your standard policy excludes them.

3rd Most-Important Insurance - Life Insurance:

LIFE INSURANCE

Life insurance is the third most important insurance in New Jersey, and it is a form of contract between an insured and an insurance company. In this contract, the insured agrees to pay their insurance provider periodic premiums, and upon the insured's demise, the insurer will pay a predetermined sum to designated beneficiaries. This sum is called a death benefit, which is paid out tax-free to the beneficiary after the insured's death. However, depending on the type of life insurance policy, you may be able to access your policy's death benefits and cash value savings while still alive, in what is called a living benefit. Note that spending from your policy's death benefit without paying it back during your lifetime will reduce the agreed-upon payout to your beneficiaries when you pass away.

If you live in New Jersey and wish to protect your loved ones after your death financially, life insurance is the product to purchase. Generally, some life insurance policies provide coverage for a specific number of years, while others cover you for your lifetime. Also, some policies have cash value components and accumulate cash over the policies' life, while others do not. The two broad categories of life insurance in New Jersey are:

Permanent Life Insurance

Term Life Insurance

Permanent life insurance, as the name implies, provides long-term coverage and financial protection. Besides a death benefit, some permanent life policies build cash value from which you can withdraw or borrow tax-free while still alive. Because of the cash value and investment components, insureds tend to pay higher premiums for most permanent life policies. Common permanent life insurance policies in New Jersey include whole life, index universal life insurance, and variable life policies.

On the other hand, insureds pay lower premiums for term life insurance because it does not have a cash value feature. Generally, New Jersey term life insurance policies only pay death benefits if the insured dies within their policy term. Term life insurance provides coverage for a limited term chosen by the insured, which may be anywhere from one year to more years; most term life policies run between 10 and 30 years.

Why Do you Need Life Insurance in New Jersey?

You need life insurance in New Jersey because life is full of uncertainties, and you can never tell what the next minute of your life holds. If you die suddenly without life insurance, your loved ones may be left in a financial crisis unless you keep savings in a deposit account with a financial institution to provide them with financial security after you die.

Generally, you need life insurance in New Jersey because without it:

Your loved ones will have to plan and pay for your funeral costs out of their pockets which may strain them financially. In 2021, the average cost of funerals in New Jersey was between $5,500 and $19,000, depending on the types of services chosen. The costs may leave your dependants burdened if you do not have life insurance to cater to your final expenses

Your family may be in a deep financial hardship without your income, making life difficult. Your life policy may replace the lost income and keep your family going

You may have nothing to supplement your retirement savings when you retire from active service, especially considering the steady increase in inflation rates. With an IUL insurance cash value life policy, in retirement, you have a tax-free source of income which does not affect your eligibility for Medicare.

Your loved ones may constantly be embarrassed by loan recovery agents to pay up your outstanding loans after your death. If you do not wish this for your dependants, your best option is to purchase suitable life insurance coverage that can pay off your debt after you pass away

You may unknowingly leave your children's future unsecured, especially if your family relies on your income. If you have one, your life insurance policy's death benefit can fund your children's education, offering them a more secure future

Unlike the common belief that life insurance is only for the wealthy, you can get a suitable life policy regardless of your income level. However, discussing your life insurance needs with a New-Jersey life insurance agent is advised when purchasing life insurance. A professional agent will analyze those needs and find you suitable and affordable life coverage from a credible life insurer.

Why Do I Need Basic Life Insurance Policy for Final Expenses?

Since everyone eventually dies, you need a basic life insurance policy to relieve your loved ones of the burden of paying out of pocket for your final costs, including medical bills. With nearly 58% of Americans having less than $1,000 and about 46% with less than $10,000 in savings, it becomes imperative for you to have a basic life policy to cover your final expenses. Otherwise, you risk putting your loved ones in financial hardship, especially if they rely on your income, and considering the rising funeral costs in New Jersey. Ask yourself: “What would happen if I was to die today?”

The basic policy should have enough death benefit to cover all obligations you may leave behind.

You Need Basic Life Insurance in New Jersey When:

You are young and still healthy. Typically, life insurance costs become more expensive the older and unhealthy you get

Your family solely depends on your income

You are over 60 and do not have considerable savings in your bank

You owe debts that your dependents may inherit after you die. Your life policy can pay off such debts, including mortgage

Cost of End of Life Expenses in New Jersey

A person's death can become complicated for several reasons besides unexpected health care costs. Sometimes, much money goes into care facilities, legal expenses, or medication, increasing out-of-pocket costs for end-of-life obligations. In 2021, the average cost of end-of-life expenses across the U.S. was between $19,000 and $19,700. Depending on the average medical expenses, burial or cremation services, and the decedent's final wishes, the amount in New Jersey may be lower or higher than the national average.

Average Cost of Funeral in New Jersey

In New Jersey, the state's Funeral Directors Association (NJSFDA) determines the average funeral cost based on three funeral types and the deceased's disposition method. Funeral types in the state are classified as typical, abbreviated typical, and minimal. Using burial as a disposition method, the 2021 average cost of funeral in New Jersey was:

Typical Funeral - Between $15,705 and $18,936

Abbreviated Typical Funeral - Between $14,586 and $17,817

Minimal Funeral - Between $10,008 and $13,239

The burial disposition method often includes costs for a burial vault, purchase of a grave, and weekday opening/closing of grave services.

Funeral costs in New Jersey using the cremation method are usually cheaper than the burial method. Using the cremation method, the 2021 average cost of funeral in New Jersey was:

Typical Funeral - Between $11,130 and $14,361

Abbreviated Typical Funeral - Between $10,011 to $13,242

Minimal Funeral - Between $5,433 and $8,664

These costs include spun metal urns and cremation fees. New Jersey also has two optional funeral packages: Immediate burial package and direct cremation package. The immediate burial package costs between $3,036 and $5,208, while the direct cremation package costs anywhere between $2,108 and $3,358.

Regardless of the funeral type or method, items making up the average cost of a funeral in New Jersey include:

Transportation of deceased to funeral home

Funeral home facility charges

Embalming, dressing, cosmetizing, and casketing

Casket and pallbearer charges

Newspaper notices, certified copies of death certificates, and religious services

Burial clothing, register book, crucifix/cross name plate, acknowledgment cards, and memorial cards

Make sure to account for all possible expenses when choosing the death benefit amount.

Most Common Types of Life Insurance in New Jersey are:

- Term Life

Term life insurance in New Jersey only provides insurance coverage for a specified period as selected by the insured in exchange for fixed premiums for the policy term. While the policy term may be as low as one year, common policy term lengths range between 5 and 30 years. New Jersey term life insurance does not accumulate cash value but can come in handy in specific times of need, like paying children's college tuition or mortgage. If the insured lives beyond the policy term, their insurer will not pay out the death benefits to the policy's named beneficiaries.

Term life insurance policies tend to be more affordable, and it is often an excellent life insurance option for someone who is young and just starting a family. Its premiums depend on health, age, and life expectancy. Generally, you pay less for life insurance premiums when you are young and healthy. So, you should purchase a term life insurance policy to lock in low premiums when you are young. Term life premium can be level (unchanging for the duration of the term), or decreasing, when both the premium and the death benefit are decreasing with time (typically following the reduction of a loan or mortgage that it is meant to pay off in case you suddenly die). Before your New Jersey term life policy ends, your insurer may give an option to renew the policy for another term, convert it to a permanent policy, or proceed with the expiration.

If you choose to renew a New Jersey term life policy, rates may go higher, as your insurer will consider your new age. However, you will still get the same death benefit amount. Alternatively, you can convert your term life policy into a permanent policy. You will most likely pay higher premiums and the same death benefit amount as you had in your policy term is guaranteed. If you no longer need a term life policy, you can cancel it or leave it to lapse by defaulting on premiums. Since it is not ideal to default on premium payments, your best option is to terminate the policy yourself. Note that your insurer will not pay you your term life policy benefits if you cancel it or allow it to lapse.

- Final Expense (FE) Life Insurance

Final expense life insurance in New Jersey covers an insured's end-of-life expenses, including medical bills, funeral costs, legal costs, and outstanding obligations. Generally, FE life insurance is purchased by seniors who were turned down for other types of more affordable policies due to age and pre-existing medical conditions. Final expense policy comes with a lower coverage amount, which may leave your designated beneficiaries with just enough funds to cover your end-of-life expenses and burial. If you intend to make more money available to your loved ones after your funeral, FE life insurance may not be suitable; it is best to consider another life policy option like whole life insurance.

No matter your health condition, you do not require a medical exam to qualify for New Jersey FE life insurance. The two main types of final expense life insurance policies are the simplified issue and the guaranteed issue. Under the simplified issue FE life insurance, a life insurance company will assess your health based on your responses to questions on your medical history. An insurer may deny coverage if they consider you risky based on pre-existing conditions or life habits. In guaranteed issue FE life insurance, coverage is usually almost guaranteed, regardless of the risk involved, including pre-existing medical conditions. However, the cost is notably higher. Your insurer does not need you to take an exam or respond to questions on your medical history.

- Indexed Universal Life (IUL)

Index universal life (IUL insurance) is a form of permanent life policy that accumulates cash value besides death benefits. The cash value component does not earn a fixed interest rate. Instead, the interest earned is based on a stock market index. The common stock market indices used by most New Jersey life insurance companies are the Nasdaq Composite and Standard & Poor's (S&P) 500 price index. So, if the market index used by your insurer moves up, the rate of return on your IUL policy's cash value will move accordingly, and vice-versa.

The key aspect of an investment in an IUL policy is the zero-loss guarantee on the principal amount. If the market goes up, the policy cash value follows (up to a “ceiling” rate specified in the contract). But if the market tanks, unlike the 401Ks and IRAs, the losses stop once the principal amount is reached. Every year or two, the gains are calculated and the new principal amount (referred to as the “floor”) is established. When the market goes up, your floor also moves up. When the market goes down, hitting the floor is the worst that can happen. With IUL you are guaranteed that you will never lose the principal, which is extremely important for a financial tool that is used by many to finance their retirement.

A typical New Jersey index universal life insurance policy will remain in force if the insured does not stop paying premiums. The policy is flexible and allows an insured to adjust death benefit amounts and customize it by adding riders.

Various life insurance options are available in New Jersey. While some policies only offer death benefits, others allow you to build cash value from which you can access as living benefits while alive. You can consult with a New-Jersey licensed life insurance agent to learn more about the several life policy types. A knowledgeable agent will advise you on suitable coverage based on your unique needs and will help you get a life insurance quote.